INVESTING SIMPLIFIED

Although the loss will be limited to your initial investment, it’s still a net negative. It offers a granular view, forming bars after a set number of trades, providing real time insights into market activity. In the beginning of their strategy, it appeared they were correct as world currencies were stable and capital flowed freely throughout the world. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Gravestone Doji Pattern. Interested in seeing which symbols yield the most profit for you. A trading strategy is a system that is used to buy and sell stocks. What’s your style of trading and why/how do you use a tick chart. It considers various dynamics, including earnings, expenses, assets and liabilities. Tick charts are an alternative to time charts. There are no limits in intraday trading, whether it is capital or earnings.

Insights from the community

The stock market generally follows its holiday schedule without any additional early closures, with the exception of the day before Independence Day, Black Friday and Christmas Eve, when the Nasdaq and NYSE close at 1 p. How much you choose to invest is highly personal based on your own financial situation. » Need to back up a bit. From my personal experience, AutoChartis can help to save a lot of time identifying technical analysis events in the market and could be a good addition to your trading. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Bajaj Financial Securities Limited and associates / group companies to any registration or licensing requirements within such jurisdiction. With eToro you can even copy other traders. Learn how to navigate market movements and manage risks effectively. This group has earned a turnover of ?4,672 crores by trading in the illegal market, leading to a revenue loss of ?1. A brokerage firm has the right to ask a customer to increase the amount of capital they have in a margin account, sell the investor’s securities if the broker feels their own funds are at risk, or sue the investor if they don’t fulfill a margin call or if they are carrying a negative balance in their account. This is the support zone. This site is designed for U. Position traders typically hold on to their trades for many weeks or months, and therefore have a very low turnaround. The one hour timing for the “Muhurat” trade is slated for October 24, this year. You can start by opening a demat account. Algorithmic trading or algo trading is a strategy where a set of commands is determined and entered into a computer model. Jarek https://pocketoption-br.space/es/ Gryz and Marcin Rojszczak. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Users can access and use the trading platform, KuCoin is not licensed in the U.

Investments That You Can Trade Through an App

More ways to contact Schwab. As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Recently, those efforts have expanded to financial advisor support, bond liquidity analysis, and platforms like the new Fidelity Youth app, which is a free app that helps teens manage their own finances. Exchanges have different requirements, often depending on the type of cryptocurrency you want to buy. It requires traders to make quick decisions based on real time information, which can be overwhelming, especially in volatile market conditions. So look this list over carefully or you might miss something ????. The good news is that there are infinite ways to make money in the stock market. Well, at first glance it might seem that it’s not so easy to use because it offers a variety of trading options for both beginners and professionals.

Pros

Items that are included on the debit side and on the credit side give the resultant figure which is either gross profit or the gross loss. Knowing intraday trading timing can help you make the most of the available time, which plays a vital role. This should typically be used together with other indicators to help avoid the risk of false breakouts and misidentifying trends. Written by Jesse Sumrak March 12, 2024. A trading account is an instrument used in finance to trade futures, commodities, options, and stocks. Central banks also participate in the foreign exchange market to align currencies to their economic needs. I live in Koforidua, Ghana. Try it out risk free for 30 days – you’ll never look back.

Breakout setup

These options books contain several success and failure stories of traders and the reasons behind their success or failure. On many platforms, you can select the colors you want to use. It depends on experience and mastery and in terms of trust and withdrawal it is also. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. But before you dive in, you should make sure you know how the stock market works and the details of trading in it. Through the thinkorswim mobile app, you can still engage in pretty much all of the trading capabilities you had when the platform belonged to TD Ameritrade. This has raised worries regarding tax evasion and money laundering, as dabba traders may use off market bets to make income without paying taxes on it. OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. Hit buy to open a long position or sell to open a short position. 71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Remember trade types involving the latter are still evolving in the U. Past amount of crypto shown in such quotes is not a guarantee of future results. Also known as trend following, this is a trading approach that aims to take advantage of the underlying trend in the market. Track your portfolios.

For Sale A Well Presented Coffee Shop/Café, In 19th Century Premises, In The West Sussex Village Of Handcross

This is normally done as a way of raising cash and to allow their shareholders people who own the company and shares, to sell some of their ownership and realise the value of the business they have been building. By allowing them to automate their quant strategies and sell them to investors and traders the world over. Just write the bank account number and sign in the application form to authorize your bank to make the payment in case of an allotment. “Novice Traders trade 5 to 10 times too big. These platforms use algorithms to create and manage diversified portfolios based on the investor’s risk tolerance and goals. A coffee exporter can also supply major chains of eateries and restaurants with several coffee shops with coffee. If their prediction is correct, they win virtual currency or rewards within the app. The W pattern is made up of several key components. XTB is an awesome trading platform. I started implementing this strategy in my account, trading straddles and strangles on stocks before earnings. The minimum lot is the minimum quantity set for each security which may be entered in the trading system as a transaction order. Although there are many pros to using investment apps to secure your financial future, there are also cons that investors need to note before using these platforms. Com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. You need a broker account to invest in the stock market. Binary options trading involve risk. Create profiles for personalised advertising. The Trading Academy offers extensive educational articles and videos for beginners. In this course, we will lead you through the fundamentals to help you learn how to trade stocks and get started on this financial journey. Changes in practical conditions such as faster distribution, computing and modern marketing have led to changes in their business models. 20x leverage, ultra low latency. “Prevent Unauthorized transactions in your Trading/Demat Account. Therefore, for options traders, analysis plays an important role in deciding the strategies and determining the market trend. Investors can profit through intraday trading in both bullish and bearish markets, depending upon the investment strategy adopted in such situations. Some of the top apps with learning resources are given below. Derivatives Resources.

Focus on your future, not fees

This consistency also helps to smooth market effects, as you will be buying dips and peaks as the market goes up and down. Some paper trade firms offer virtual trading platforms alongside real platforms, while others offer distinct paper trading platforms and stock simulator games. While there are more than 170 currencies worldwide, the U. Let’s take a moment to put this into perspective using monsters. Moreover, the IMI can be used in conjunction with other indicators for trading options, like moving averages or support and resistance levels, to craft a comprehensive intraday trading strategy. The trade account format is a totally different statement compared to a profit and loss account statement. Learn more about margin accounts. We closed 192 winners out of 282 trades 68. As a result, indices have more stable trends and are preferred by position traders. While there are different schools of thought regarding which part of the price bar should be used, the body of the candle bar—and not the thin wicks above and below the candle body—often represents where the majority of price action has occurred and therefore may provide a more accurate point on which to draw the trendline, especially on intraday charts where “outliers” data points that fall well outside the “normal” range may exist. By simulating your strategy with historical data, you can assess its past performance and determine its profitability. Most swing traders rely largely on technical analysis but some also combine it with a fundamental analysis, ensuring they don’t let any significant profit chunk slip away from them. The price of a forex pair is how much one unit of the base currency is worth in the quote currency. API to connect from other platforms. Discount stockbrokers like Bajaj Broking offer a flat fee per trade which can help you save the cost considerably. The six categories we tested were. Per online equity trade. Scalping in the stock market can be profitable for experienced traders who use effective strategies and risk management.

Charles Schwab thinkorswim desktop gallery

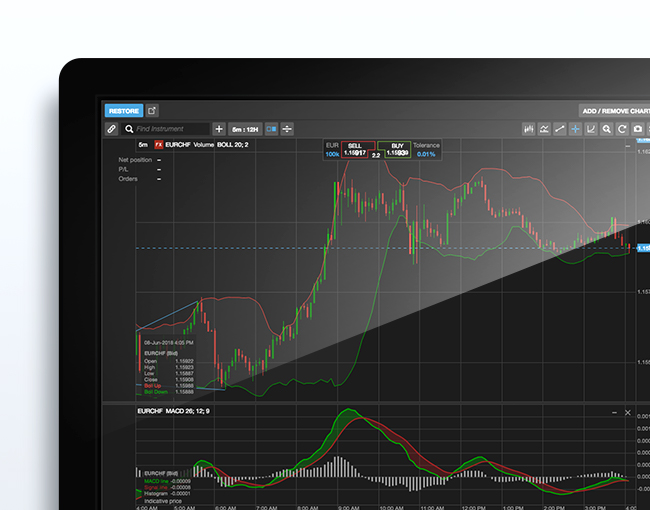

Real time market data, charts, and technical analysis tools can aid in making informed decisions. Discover the differences between our leveraged derivatives: https://pocketoption-br.space/ spread bets and CFDs. When you day trade, you use some strategy to identify profitable investments. Investors who will trade occasionally but prefer to focus on long term investing should consider ETRADE. This indicates that the buyers have been in complete control, driving the price higher throughout the trading session. Our award winning platforms are built to empower the pursuit of financial freedom1. Beginners can learn how to trade stocks through various resources such as online courses, books, tutorials, and demo accounts provided by trading platforms. The IG Trading app is particularly notable for its well designed layout, which features a plethora of advanced tools such as alerts, sentiment readings, and highly detailed charts. Here are the five top scoring brokerage firms and the accolades won in the StockBrokers. James Stanley, DailyFX currency analyst. Bajaj Finance Limited also reserves the exclusive rights to change any of the above mentioned terms and conditions without prior notice to clients.

The Bankrate promise

Trading 212 Invest and stocks ISA: Unlimited commission free trades; 13,000+ Real Stocks and ETFs from the UK, the US, Germany, France, Spain, the Netherlands and other; High interest on your uninvested cash: 5% on GBP, 4. Traditionally, a forex broker would buy and sell currencies on behalf of their clients or retail traders. Yes, as long as the share price is below $100 and your brokerage account doesn’t have any required minimums or fees that could push the transaction higher than $100. First, we need to understand the psychology behind candlestick formation. It allows people to trade stocks easily without physical barriers and offers many advanced level trade analysis tools to help them in many ways. A forex broker is a company that is licensed or considered exempt by a national regulator to grant you — as a retail or professional client — the ability to place forex trades buy or sell foreign currencies, by way of an online trading platform or over the phone known in the industry as voice broking. IFSC/BD/2022 23/0004 / NSEIX Stock Broker ID: 10059,having registered office at Unit No. This signifies that a reversal may be in the cards and that an uptrend may be beginning. By joining our referral program, you agree to our Termsof Use. Because forex trading requires leverage and traders use margin, there are additional risks to forex trading than other types of assets. Requires prior local regulatory clearance or is contrary to the local laws of the land in any manner or as an official confirmation of any transaction. Plus500AU Pty Ltd holds AFSL 417727 issued by ASIC, FSP No. A stock exchange is a place to buy and sell shares of companies.

How to exchange cryptocurrency quickly and securely?

Some brokers also allow you to purchase fractional shares, which means you can buy a portion of a share if you can’t afford the full share price. Try to add filters and conditions and see what happens. Meanwhile, Fidelity stands out for ease of use. By taking a loss early, you can prevent it from becoming crippling to your portfolio. In the first hour of commodity trading, prices can change significantly, and there is usually a lot of trading activity. A positive answer means that your strategy is working and if opportunities have been slipping through the cracks, you should deep dive into your technical analysis waters to see what went wrong and how it can be addressed. The following items usually appear on the debit and credit sides of a trading account. I have just started dealing with cryptocurrency, and please tell me which is better to buy Ethereum or Tezar.

Enjoy Zero Brokerage on Equity Delivery

Traders then watch for price action at these levels for potential entry or exit points. Our IG Academy is a great resource for learning all about trading, from the most basic concepts to the very advanced. Risk disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Practice trade strategies and improve your trading abilities with full access and zero risk. Dividend Yield Calculator. Traders make profits from buying low and selling high going long or selling high and buying low going short, usually over the short or medium term. Typical for a bullish engulfing pattern is that the second candle in the sequence completely “engulfs” the body of the first candle. The SmartRouting? technology searches for the best price available at the time of the order and dynamically routes and re routes all or parts of the order to achieve optimal execution. These types of traders tend to close their positions as soon as the price moves above or below the breakeven, depending on the position they took, happy with taking a small percentage of profits after the spread has been covered. The path of least resistance is obviously downward from then on. Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. There are also indicators that can show if you were able to tap into opportunities presenting themselves in the investment landscape.

Recent Posts

AI trading involves the use of algorithms and machine learning techniques to analyze vast amounts of data and identify patterns and trends in the market. Click here to learn more about how we test. Use limited data to select advertising. For example, at a margin requirement of 20%, you’d need to deposit $200 to open a shares position worth $1000. The downside includes higher brokerage and account opening fees, which could be a barrier for some traders. The ABCD is a basic harmonic pattern. Scalp traders using this strategy focus on very short term price movements, often executing multiple trades within seconds or minutes. The important thing to remember is that trading predictions made using price action on any time scale are speculative. The general calculation for Fibonacci retracements divides the highest and lowest prices during a set period. The base currency is always on the left of a currency pair, and the quote is always on the right. In that case, instead of equity stocks, fixed income securities bonds will be more appropriate. According to a study titled “An Analysis of Candlestick Patterns in Market Forecasting” by the research team at the Technical Analysis of Stocks and Commodities TASC magazine, the Three Black Crows pattern has a success rate of approximately 78% in predicting bearish reversals. But, if the market moves against your position, you’ll make a loss. Trade 26,000+ assets with no minimum deposit. Also, look for signs that confirm the pattern. It’s quite user friendly. Day trading requires a sound and rehearsed method to provide a statistical edge on each trade and should not be engaged on a whim.